The pet food market is experiencing rapid growth, driven by consumer demand for higher quality, transparency and tailored nutrition for pets. Global sales are expected to reach USD 145 billion by 2030, underscoring the sector's growing importance within the pet care industry.[1] From budget to super-premium products, the market mirrors trends in human food, with an emphasis on premium ingredients, complete nutrition, 'natural' and 'fresh' options and diets tailored to individual pet needs.

Key trends shaping the pet food market:

- Pet humanization

- Health and wellness

- Sustainability

- Convenience

Pet owners are increasingly treating their animals as family members, driving demand for high-quality, premium pet food. This is reflected in growing interest in natural, organic and GMO-free formulations

The increasing focus on pet health and nutrition is fueling demand for functional pet foods that deliver specific health benefits for all life stages (puppy/kitten, adult, senior), such as weight management, joint and bone health improved digestion and immune support. With growing awareness of allergies and sensitivities, specialty diets are also gaining popularity, including hydrolyzed protein, single-protein, novel-protein, grain-free and limited-ingredient options

Environmental concerns are also influencing consumer preferences, leading to growth in sustainably produced and eco-friendly pet food. The popularity of plant-based and insect-based alternatives to traditional meat-based diets continues to increase

There is rising demand for convenient pet food formats, including freeze-dried, dehydrated and ready-to-eat meals. Subscription-based services and direct-to-consumer delivery models are also experiencing significant growth

Consumers are increasingly relying on product claims and ingredient labels to select products that meet their specific requirements. As formulations grow more complex, verifying ingredient authenticity is essential to maintaining safety, quality and consumer trust.

Accidental and intentional adulteration pose serious threats to pet food safety. Pet food fraud is a serious criminal offense, enabled by vulnerabilities in the supply chain that permit ingredient substitution, concealment and mislabeling. These practices have the potential to inflict significant harm to animal health, consumer trust and industry integrity.

To ensure authenticity and mitigate these risks, the following methods are commonly used in pet food testing:

- Elisa methods:

- Enzyme-linked immunosorbent assay

- High sensitivity (allergen level)

- Interrogation for specific species

- PCR/real-time PCR/digital PCR:

- DNA-based approach

- Limit of detection: 0.01%, 0.1% and 1%

- Interrogation for specific species

- NGS and DNA barcoding:

- Identification of specific animal species by comparing DNA sequences with known reference sequences

- Detailed insight into the species composition of complex pet food products

- Detection of even traces of ingredients

- Detection of potential adulteration or mislabeling of ingredients

- 'Blind' approach

- Mass spectrometry:

- Liquid chromatography-mass spectrometry (LC-MS)

- Identification and quantification of specific proteins or peptides

- Verification of the presence of declared animal and plant species

Study objectives

With a diverse range of pet food products and rising consumer expectations around transparency and sustainability, this study aimed to evaluate the accuracy of ingredient labeling using advanced molecular tools. The objective was to detect discrepancies between label claims and actual content, highlighting authenticity challenges, and assess potential impacts on consumer trust. Our testing strategy provides an independent and reliable verification method to support quality assurance within the pet food supply chain.

Methodology

In early 2024, we applied accredited NGS techniques to ten mid-range to premium dog and cat food products purchased from UK high street retailers. The selection included various wet food formats, such as tins and pouches, and product labels were reviewed for clarity in their declarations regarding meat, fish and crustacean content.

Each sample underwent analysis at our UK laboratory using species-specific NGS panels. Simultaneously, DNA testing for meat, fish and crustacean identification was conducted at our facility in Portugal.

Results

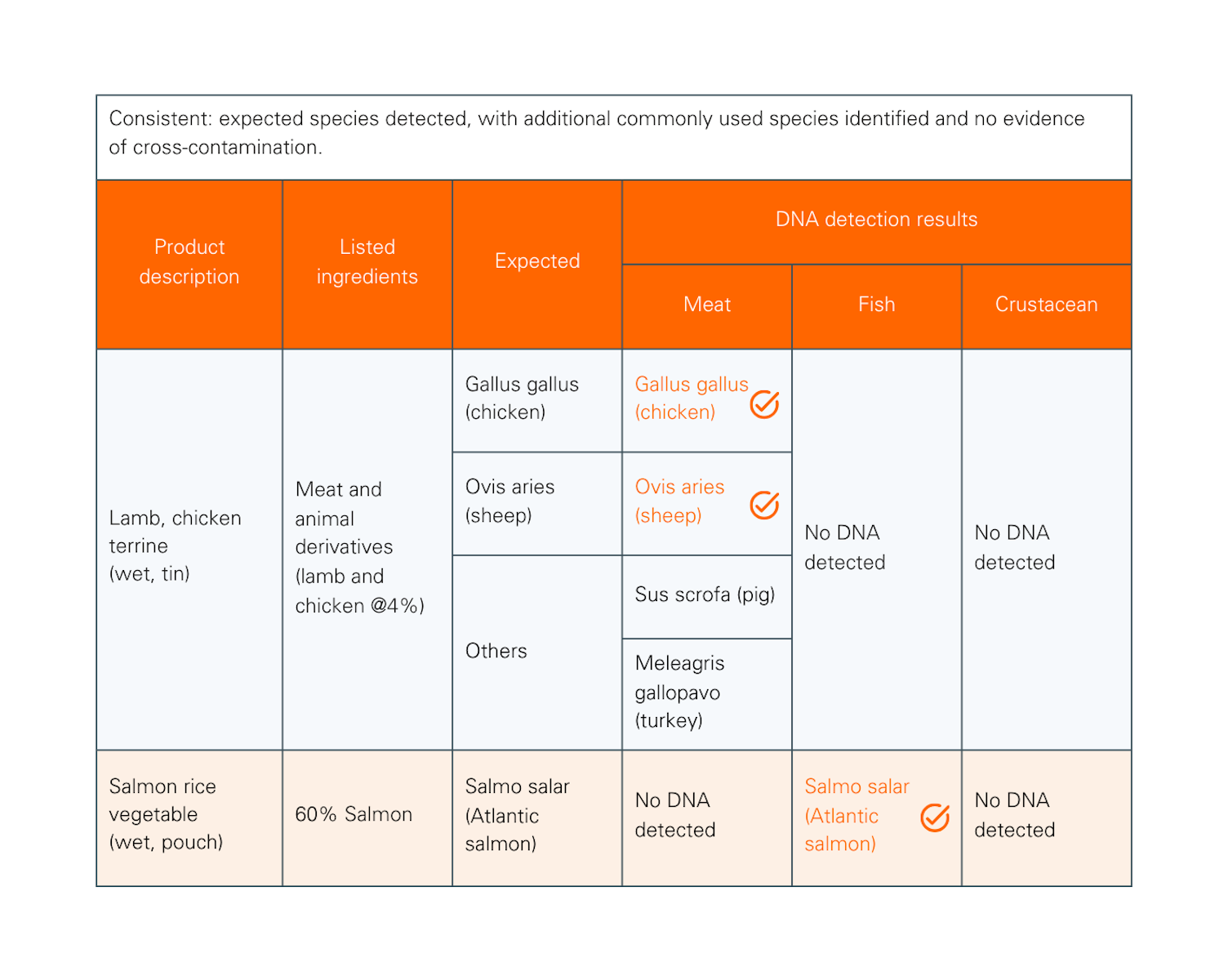

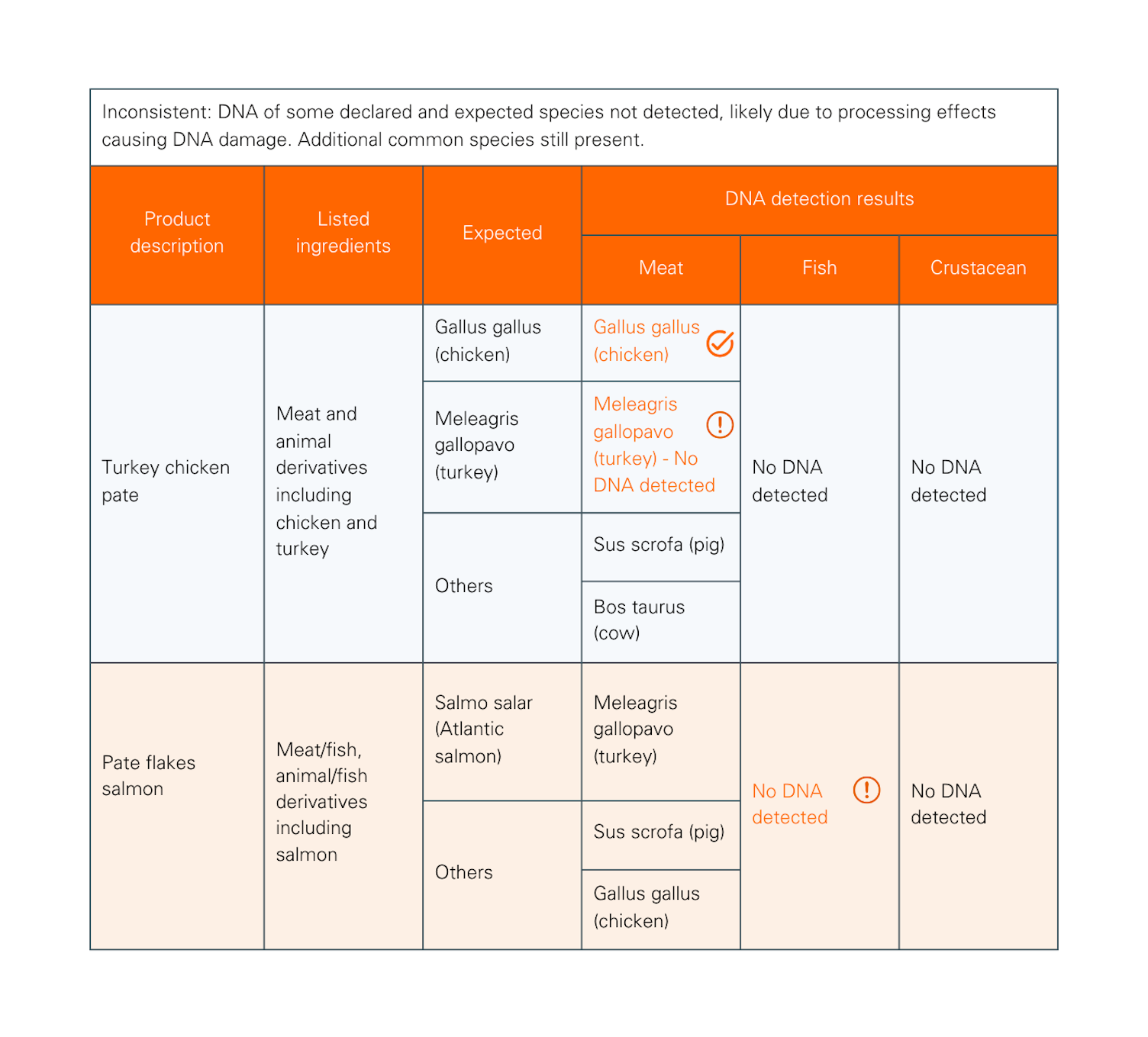

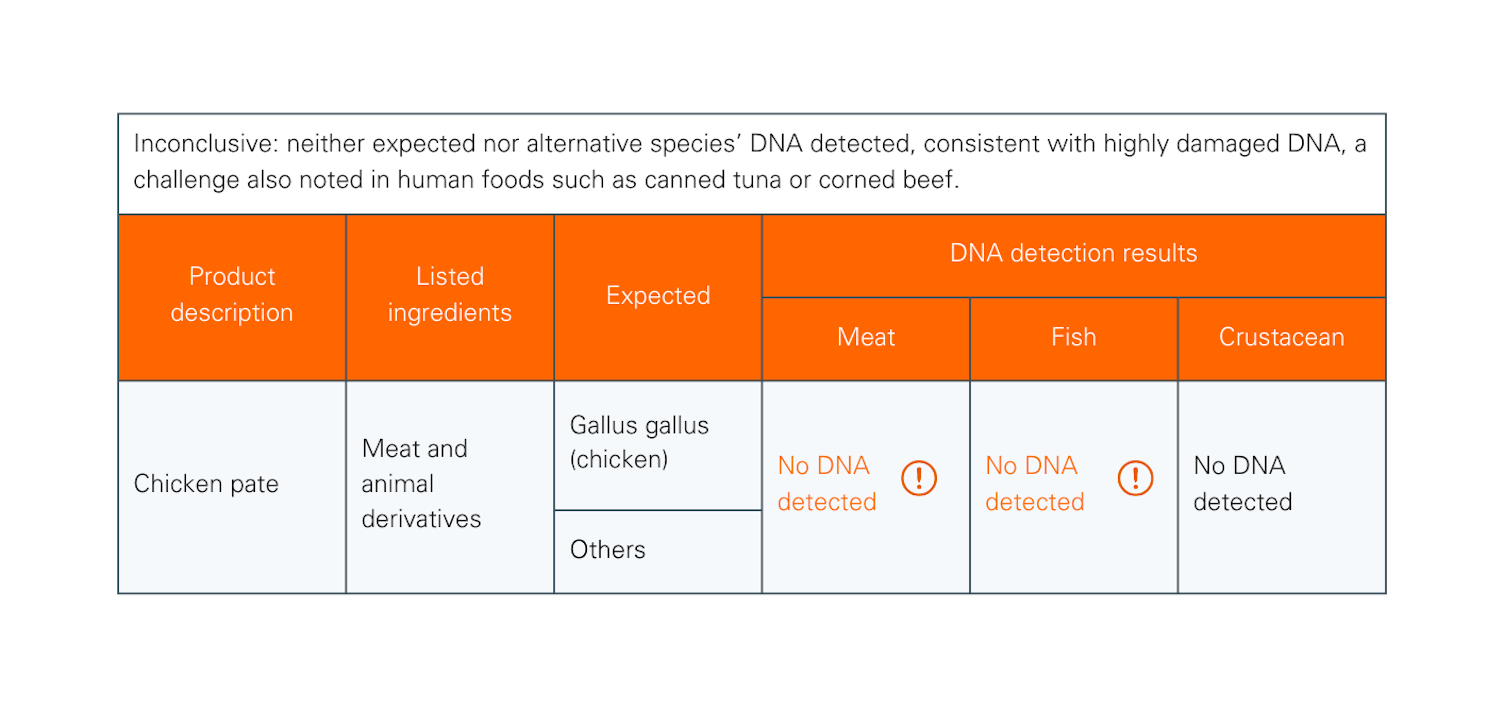

Results were categorized as:

- Consistent: expected species detected, with additional commonly used species identified and no evidence of cross-contamination

- Inconsistent: DNA of some declared and expected species not detected, likely due to processing effects causing DNA damage. Additional common species still present

- Inconclusive: neither expected nor alternative species’ DNA detected, consistent with highly damaged DNA, a challenge also noted in human foods such as canned tuna or corned beef

Study insights

This study demonstrates the value of NGS as a tool for pet food authentication, capable of detecting even trace ingredients and uncovering mislabeling or adulteration risks. While DNA degradation limits detection in highly processed products, combining NGS with complementary methods like digital PCR and mass spectrometry strengthens the overall verification process. As novel ingredients, such as insect proteins, become mainstream, continued expansion of genomic reference databases will be vital in improving the resolution and reliability of pet food authentication strategies.

The study highlights the importance of accurate product labeling in a growing and diverse pet food market, where evolving consumer demands and complex formulations make ingredient authentication increasingly critical.

SGS pet food testing services

SGS conducts chemical contaminant analysis alongside traditional and molecular microbiological testing to reduce the risk of placing adulterated products onto the market. Our laboratory analyses support the requirements in the nutrition testing standards of the Association of American Feed Control Officials (AAFCO) and the European Pet Food Industry Federation (FEDIAF).

Testing solutions include:

- Microbiological testing

- Sensory and physical examination

- Contaminants including mycotoxins, heavy metals, pesticide and veterinary drug residues, dioxins and PCBs

- Nutritional analysis

- Environmental monitoring

- Food fraud and DNA analysis

- Contaminant migration from packaging

- Label reviews

These services help reduce the risk of adulterated products entering the market and support transparency and compliance across the pet food supply chain.

For further information contact:

Dr. Christophe Noel

Director of Food Innovation, PhD, FIFST

Health & Nutrition

t:+44 (0)191 243 0871

About SGS

SGS is the world’s leading Testing, Inspection and Certification company. We operate a network of over 2,500 laboratories and business facilities across 115 countries, supported by a team of 99,500 dedicated professionals. With over 145 years of service excellence, we combine the precision and accuracy that define Swiss companies to help organizations achieve the highest standards of quality, compliance and sustainability.

Our brand promise – when you need to be sure – underscores our commitment to trust, integrity and reliability, enabling businesses to thrive with confidence. We proudly deliver our expert services through the SGS name and trusted specialized brands, including Brightsight, Bluesign, Maine Pointe and Nutrasource.

SGS is publicly traded on the SIX Swiss Exchange under the ticker symbol SGSN (ISIN CH1256740924, Reuters SGSN.S, Bloomberg SGSN:SW).