We are focusing investment in Connectivity to increase our competitive advantage.

- Strategic objectives 2023 and beyond

- Consolidate our leading market position

- Leverage market growth supported by the proliferation of 5G technology and loT devices

- Continue to build cybersecurity expertise as an integral part of our 'total solution'

- Focus on automotive and semiconductor industries as key opportunities

- Continue to lead the expansion of the domestic Chinese market

- New data services to generate first revenue by 2023

- Progress during the year

- We are solid leaders in Softlines and already ahead of target for Connectivity in Top 3

- Significant capex has been approved for East Asia and the USA

- New cybersecurity laboratories have been opened in East Asia

- Supply chain challenges temporarily slowed progress but expect the eMobility development and semiconductor global demand to boost this end of the year

- Invested in a program called 'China Import' providing support to exporters from North America and Western Europe who want to sell goods on China's domestic markets

- First European retailers have committed to use our new digital solution Truum™

| Capex intensity | Net working capital intensity | Last 12 months return profile | M&A appetite |

|---|---|---|---|

| Higher | Lower | +++ | High in Connectivity |

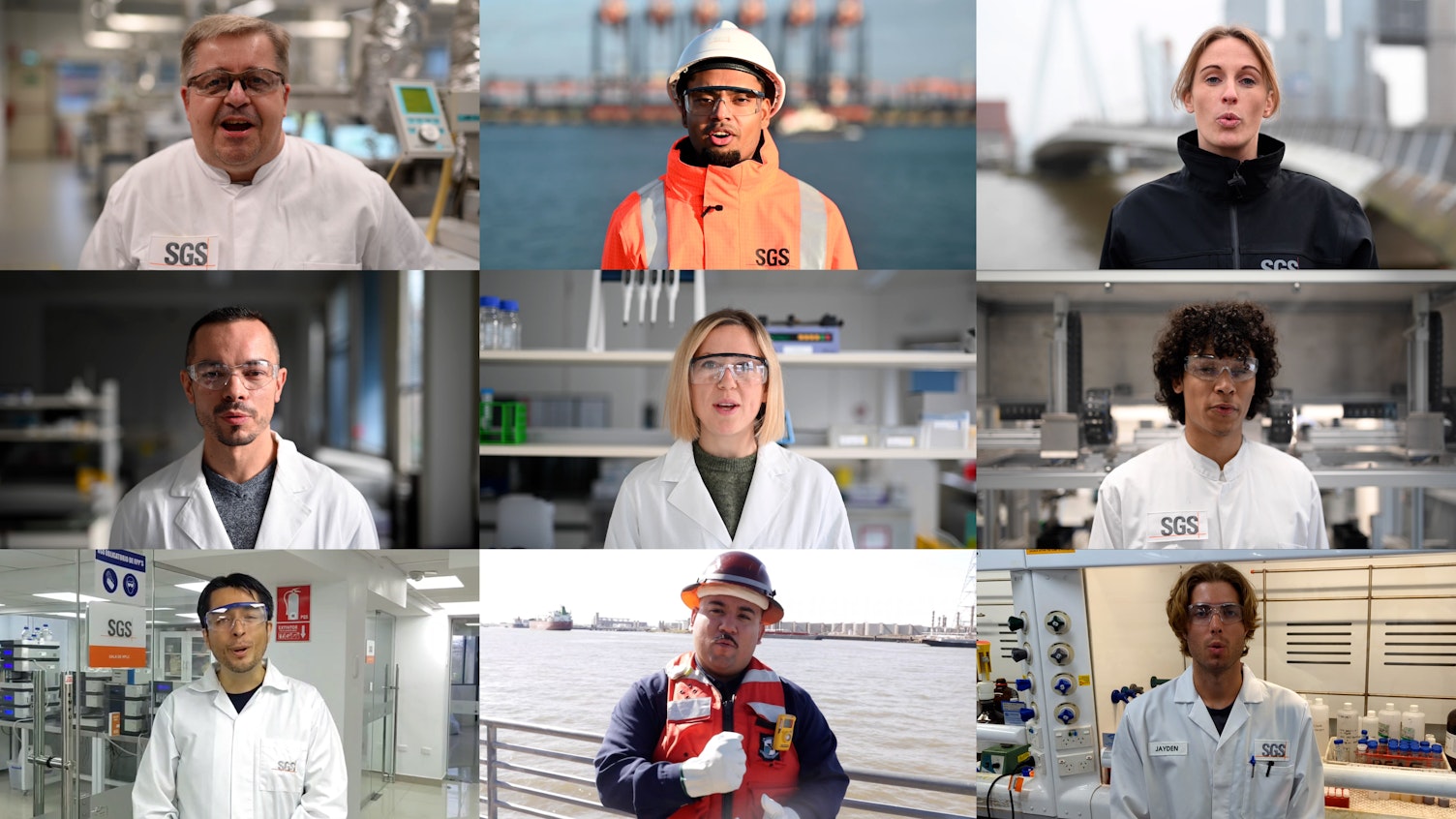

Our growing portfolio of sustainability solutions

During 2022, we launched various SGS product marks (sustainability, certification and performance) addressing current demand from our customers across all product categories.