A youthful, always-online consumer base across the Middle East is turning sustainability from a marketing theme into a buying requirement, forcing companies to publish evidence on environmental and social impact or risk losing trust and market share. The shift is strongest among Gen Z and Millennials, whose purchasing and employment choices are tied to perceived brand values.

A youth wave meets always-on scrutiny

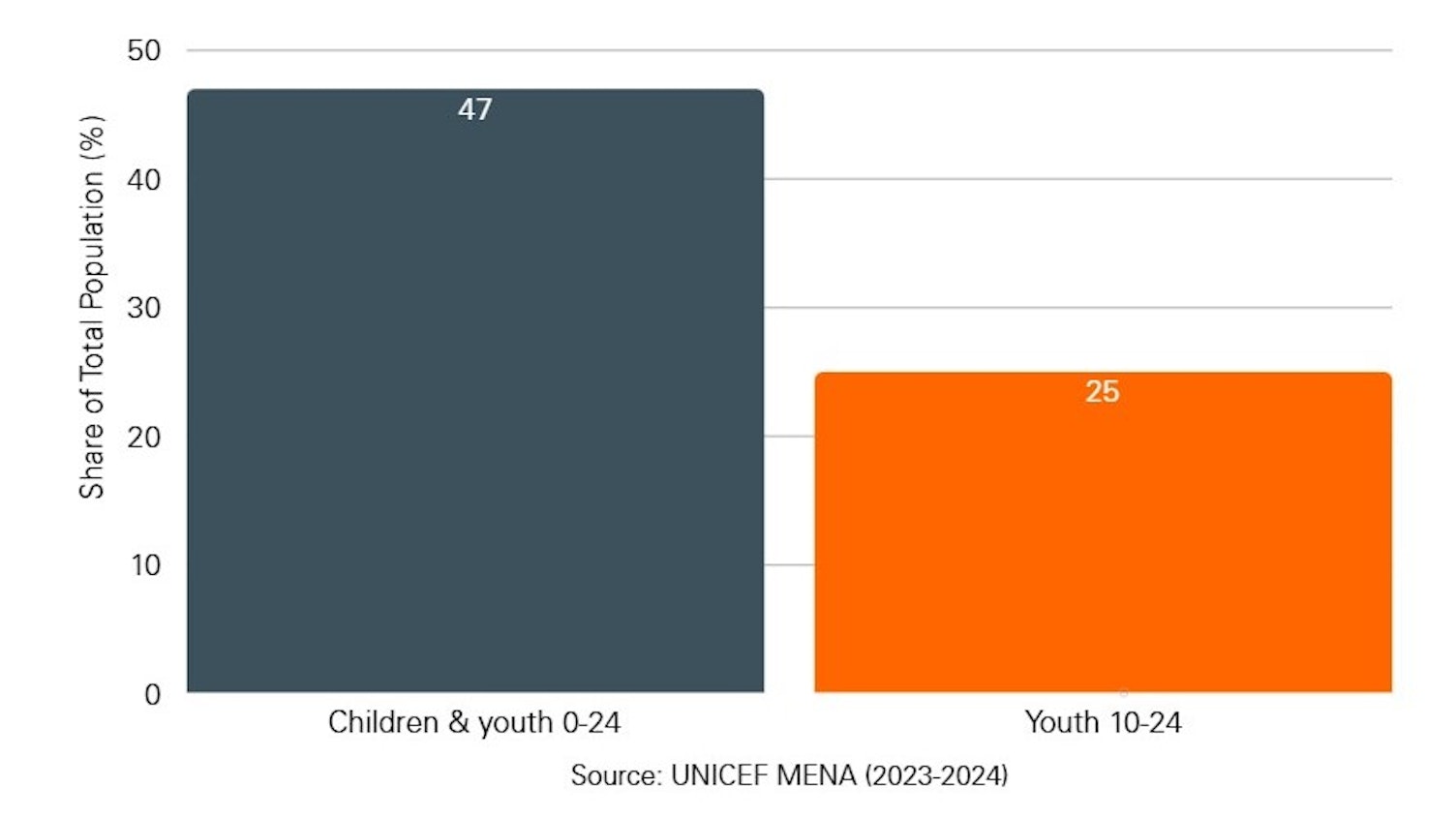

The Middle East and North Africa is one of the world’s youngest regions. On 2023–2024 estimates, children and youth aged 0–24 make up about 47% of the population, and young people aged 10–24 account for about 25%. That creates a large cohort that expects brands to act responsibly and report credibly.

Mobile use amplifies that scrutiny. Average mobile data traffic per connection in MENA is projected to triple between 2023 and 2030, driven by video-first habits and social discovery, which gives audiences constant visibility into brand claims.

MENA Youth Demographics at a Glance

Values show up at checkout

Across the region, intent is translating into action. In the ASDA’A BCW Arab Youth Survey, 65% of youth in GCC states, 58% in North Africa and 51% in the Levant say they would support boycotting brands that harm the environment. Global consumer data points in the same direction: about 60% say sustainability is an important purchase factor, 57% say they are willing to change buying habits, and 52% want products with less packaging.

Millennials are the price leaders, with roughly 7 in 10 willing to pay more for sustainable options. For pricing decisions, PwC’s 2024 Voice of the Consumer places the average premium at about 10% for sustainable products, a benchmark retailers in the Middle East are testing as they expand lower-carbon and locally sourced lines.

How people discover and decide

Social platforms are now the region’s biggest discovery engine. Two thirds of Middle East consumers discover new brands on social media, and a majority report being persuaded to buy by an influencer or celebrity. That increases both the opportunity to educate and the risk of claims being challenged in public.

Generation definitions used by many researchers place Gen Z as 1997–2012, Millennials as 1981–1996 and Gen X as 1965–1980, a useful frame for segmenting tone and proof points in campaigns.

Companies move from ambition to reporting

Corporate action is catching up. As reported by PwC Middle East, eight in ten companies in the region now have a formal sustainability strategy, and more than half say it is embedded across the organisation. About one in two either already have a Chief Sustainability Officer or plan to appoint one within the next 12 months. At the same time, investors remain cautious, with reports noting that many believe some sustainability claims are not fully supported.

The next step is proof. Boards are being asked to turn pledges into auditable numbers. That means publishing decision-useful ESG data on a fixed schedule, obtaining external assurance, and using recognised certifications where relevant. Examples include ISO 14001 for environmental management, ISO 50001 for energy management, ISO 14064 for greenhouse-gas verification, and supply-chain certifications such as FSC or PEFC for materials, and social audits like SMETA or SA8000. Aligning disclosures with global frameworks such as IFRS Sustainability (S1/S2) or GRI, and securing limited or reasonable assurance, helps close the trust gap with investors, lenders and large buyers.

Local proof points resonate

Across the Middle East, what moves younger buyers is sustainability they can see. In Gulf fashion and hospitality, for instance, more labels and hotels now publish product and property metrics such as certified materials, energy per occupied room, and water recycled per site. One major regional hotel alliance reports its eco-certified portfolio has grown by 150 percent since 2023, with guests spending 26 percent more per stay at certified properties, a sign that visible standards change behavior as well as brand perception.

In North Africa and Egypt, sustainability stories land when they solve real constraints. Agriculture uses about 85 percent of freshwater withdrawals in the Near East and North Africa, so efficiency is a consumer and producer imperative. FAO case work in Jordan shows that drip irrigation with basic soil-moisture control can cut on-farm water use by 20 to 50 percent while lifting yields by 15 to 20 percent, a proof point that is easy to translate into pricing, sourcing and community messaging.

Retail and FMCG signals are visible at checkout. Abu Dhabi’s single-use bag rules have cut plastic bag use by about 95 percent, saving more than 360 million bags since 2022, which helps explain why refill, reuse and clear recyclability guidance are moving from pilot to planogram across large stores.

In dense urban hubs, last-mile operators are leaning on route optimization and micro-fulfilment to shrink delivery footprints. Academic and field studies indicate that better routing can reduce fuel use by roughly 8 to 20 percent, reinforcing the idea that small operational changes add up to measurable gains consumers can understand.

Risks and roadblocks

Momentum comes with execution gaps. As reported by PwC Middle East, disclosure remains uneven and often voluntary, with limited assurance and a mix of overlapping standards that invite greenwashing accusations and investor scepticism. Fragmented taxonomies across markets complicate data collection, while skills and systems to track emissions, water use, and labour indicators are still developing. Companies are responding with common reporting templates, targeted training, and stronger internal controls, yet until definitions align and capabilities deepen, progress will be uneven across the region.

What marketers are changing now

Marketers across the Middle East are shifting from slogans to proof. The aim is to build long-term relationships by aligning actions with values, not just messages.

Publish fewer, better metrics. Start with a small set of indicators that really matter. Define the scope, the baseline year, and whether the numbers are assured. Use plain units people recognise, such as “kilograms of CO₂e per unit sold” or “litres of water per room night.” Report at a regular cadence and keep the method consistent so readers can compare results over time.

Show the work on social. Short, verifiable clips from farms, factories, and audits help audiences see what changed and how. Add time stamps, geotags, and certificate numbers where possible. The emphasis on evidence matters because social channels strongly influence buying in the region. Consumer research finds social media has the greatest impact on purchase decisions for Middle East shoppers.

Price for trust, then test. When an attribute is verified, introduce a small premium and test it for a set period. Track conversion, repeat purchase, and returns, not only clicks. Use the global benchmark as a guide: Industry studies report that consumers are willing to pay about 9.7 percent more for sustainable goods. Expand only if elasticity holds.

Close the loop with youth. Create small advisory panels of students and young professionals and use them to review claims and content before launch. Publish a simple “you said, we did” note after each campaign. This matters because young Arabs say they will punish brands that fall short on the environment, which raises both the risk of missteps and the value of early feedback.

Bottom line

A young, always online region is reshaping how brands earn attention. Social discovery and climate risk are turning sustainability from a differentiator into a basic expectation, especially for Gen Z and Millennials. The brands that endure will set a small number of clear targets, publish auditable data on progress, and show local results that readers can verify. That combination builds trust, supports pricing power, and keeps both customers and talent on side.

About SGS IMPACT NOW for sustainability

Combining our global access to best practices across all industries with hands-on expertise, we are empowered with a pragmatic how-to approach and a can-do attitude to advisory and services. As a sustainability and ESG leader that has implemented many of our services internally, we pride ourselves on “walking the talk.”

Our sustainability impact services and solutions are broadly categorized under Climate, Circularity, Nature and ESG Assurance, to enable you to pinpoint exactly what you need to make your impact now.

Stay informed. Subscribe now.

For exclusive insights on management systems, ISO standards and sustainable business growth, subscribe to our monthly email newsletter.

About SGS

SGS is the world’s leading Testing, Inspection and Certification company. We operate a network of over 2,500 laboratories and business facilities across 115 countries, supported by a team of 99,500 dedicated professionals. With over 145 years of service excellence, we combine the precision and accuracy that define Swiss companies to help organizations achieve the highest standards of quality, compliance and sustainability.

Our brand promise – when you need to be sure – underscores our commitment to trust, integrity and reliability, enabling businesses to thrive with confidence. We proudly deliver our expert services through the SGS name and trusted specialized brands, including Brightsight, Bluesign, Maine Pointe and Nutrasource.

SGS is publicly traded on the SIX Swiss Exchange under the ticker symbol SGSN (ISIN CH1256740924, Reuters SGSN.S, Bloomberg SGSN:SW).

Floor No.1, Building No.340 Street 230, Zone 24,C Ring Road,

24140,

Doha, Qatar